Interest Rates, Financial Instruments, and Financial Markets

Future Value, Present Value, and Interest Rates

Bonds, Bond Prices, and the Determination of Interest Rates

Future Value, Present Value, and Interest Rates

For much of history, lending and interest were viewed with suspicion. Philosophers like Aristotle condemned charging interest as “unnatural,” and religious leaders often forbade it. Yet, over time, societies realized that lending is not about “money breeding money” but about opportunity cost—the idea that a lender gives up other uses of money and needs compensation. Today, interest and credit are at the very core of modern economies, making possible everything from buying a car to financing multinational corporations. And still, there are forms of lending that are considered unethical or even illegal in some states, such as payday loans, vehicle title loans, or loan-sharking practices that carry extremely high interest rates.

Time Has Value: The Idea of Future Value

Future value answers a simple question: how much will an amount invested today be worth in the future? If you deposit $100 at 5% interest, in one year you’ll have $105. Leave it for two years, and because of compound interest (earning interest on both your deposit and prior interest), it grows to $110.25. Over 10 years, that $100 becomes more than $162. Compounding makes growth accelerate over time.

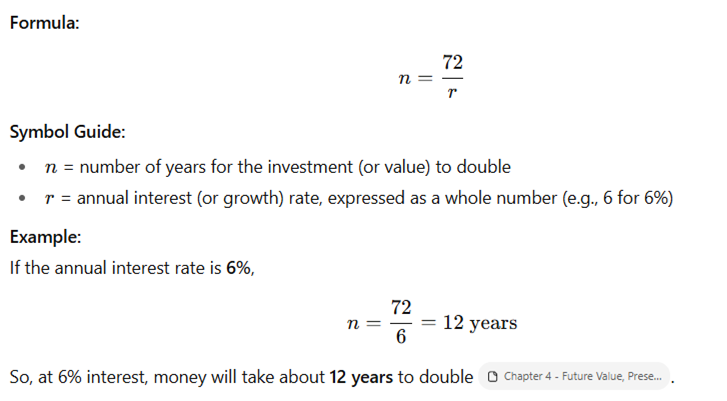

This principle also explains the rule of 72: to estimate how long it takes for money to double, divide 72 by the interest rate. At 6% interest, money doubles in about 12 years; at 12%, it doubles in just 6 years.

Present Value: Bringing the Future Back to Today

While future value looks ahead, present value works backward. It asks: what is a promise of $105 next year worth today? At 5% interest, it’s worth $100. The formula discounts future payments, showing that the further away a payment is—or the higher the interest rate—the less it is worth today.

This concept is critical for evaluating investments, loans, and bonds. It allows comparisons between different streams of payments and helps investors decide which option yields the best return.

Applying Present Value: From Machines to Mortgages

Businesses and individuals use present value to guide decisions. For example, a factory considering a $1 million machine can calculate whether its future revenues justify the cost. If the machine generates returns above the internal rate of return (IRR)—the interest rate that makes the present value of future cash flows equal to the cost—then it is a good investment.

Similarly, bonds are priced using present value. A bondholder receives a series of coupon payments plus repayment of principal at maturity. The bond’s price equals the sum of the present values of those payments. This explains why bond prices fall when interest rates rise and rise when interest rates fall.

Real vs. Nominal Interest Rates

Not all interest rates are created equal. The nominal interest rate is the percentage quoted by lenders, but what truly matters is the real interest rate—the nominal rate minus inflation. If you earn 5% interest but inflation is 5%, your real return is zero. This is captured by the Fisher equation:

Nominal Interest Rate = Real Interest Rate + Expected Inflation

This distinction matters for savers, borrowers, and policymakers. It explains why interest rates are high in countries with high inflation and sometimes even negative in places with deflation.

Why It Matters

Future value and present value provide the mathematical foundation for nearly every financial decision. They explain why saving early matters, how to evaluate investments, why interest rates move markets, and why inflation erodes wealth. Whether you are taking out a student loan, buying a bond, or saving for retirement, understanding these concepts ensures better choices today for stronger financial outcomes tomorrow.

Formulas

We must learn how to calculate and compare rates on different financial instruments.

We need a set of tools:

Future value

Future value in one year = Present value of the investment + Interest

Present value

Present value = Future value of the payment divided by (One plus the interest rate)

Present value of bond principal

Present value of bond principal (PBP) = Principal payment (F) divided by (One plus the interest rate) raised to n.

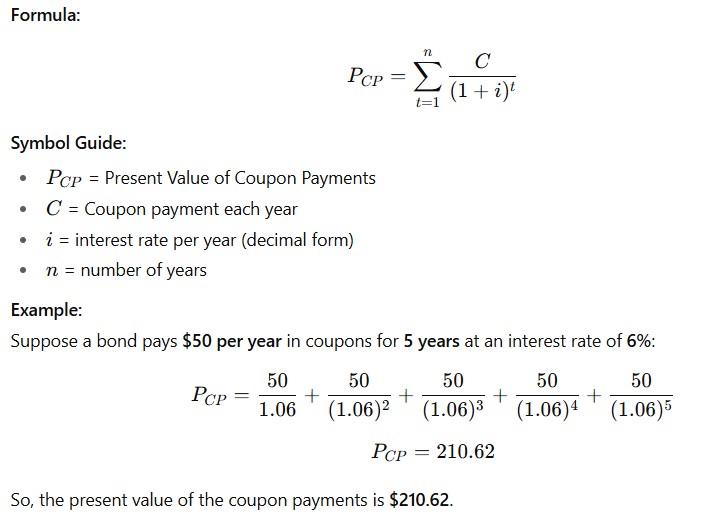

Present Value of Coupon Payments

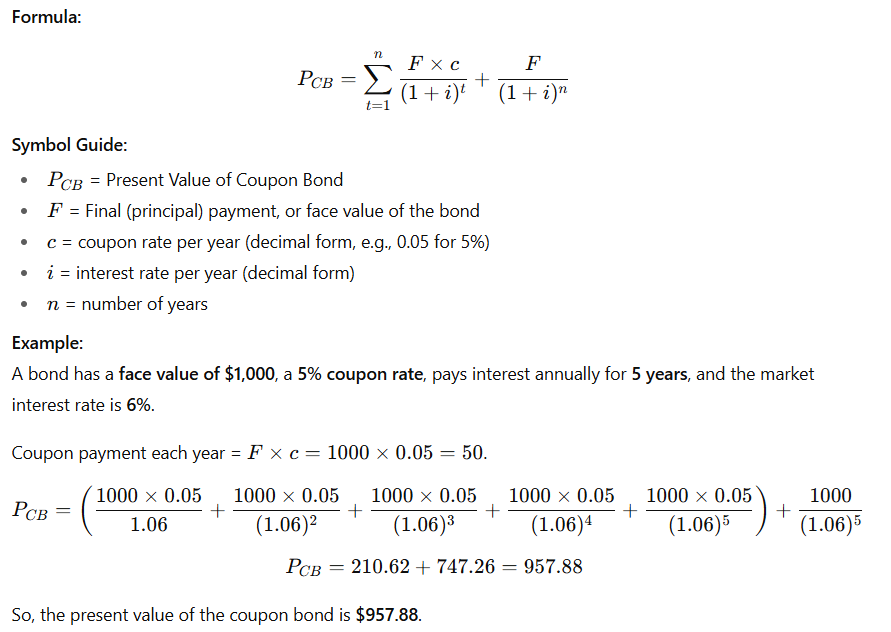

Present Value of a Coupon Bond

Rule of 72

Real Interest Rate

Internal Rate of Return (IRR)

Understanding Risk

Why does

Bonds, Bond Prices, and the Determination of Interest Rates

Modern